Stay up-to-date on the latest news stories about the SC Venue Crisis, legislation, and the businesses affected by the ever-rising liability insurance rates plaguing our state.

The links below document the SC Venue Crisis.

FitsNews –

Liquor Liability Update: Well Played, Trial Attorneys

3.12.25

Live5 News –

SC House unanimously passes liquor liability reform

3.4.25

FitsNews.com –

South Carolina Trial Lawyers Blasted In New Advertisement

3.4.25

FitsNews.com –

Tort Reform Distraction: A Winning Strategy?

3.2.25

FitsNews.com –

High Noon For Tort Reform In South Carolina

3.2.25

TheNerve.com –

Turf War: How a liquor-liability reform bill died in the S.C. Senate

2.26.25

Post Courier –

Senate Republicans wage 6-figure ad campaign to counter attacks on lawsuit reform bill

See video below

2.24.25

FitsNews.com –

South Carolina ‘Tort Tax’ Tops $3,544 Annually

2.21.25

FitsNews.com –

Analysis: South Carolina’s unfair civil liability system

2.21.25

Forbes.com –

Lawmakers See Tort Reform, Like Tax Relief, As Way To Reduce Costs

2.19.25

Upstate Business Journal –

Push for tort reform in SC gaining traction among business community

2.13.25

Charleston Chamber of Commerce –

Tort Reform Made Simple: Why It Matters for Businesses and Consumers

2.3.25

7News WSPA –

Bill to address liquor liability laws in South Carolina

1.27.25

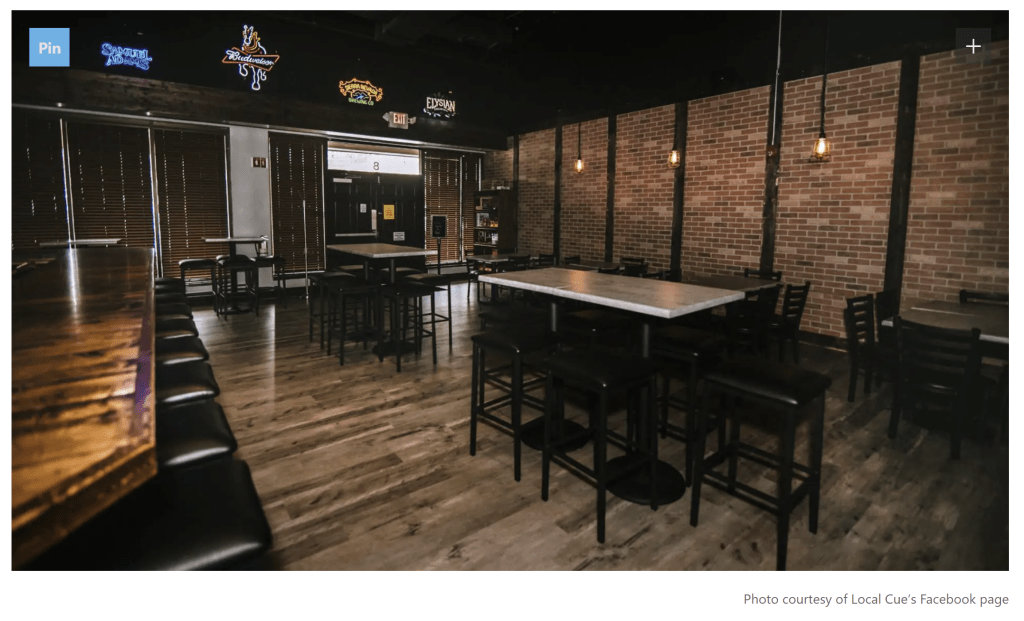

Upstate Business Journal –

Local Cue to halt service of alcohol, cites venue crisis

7.18.24

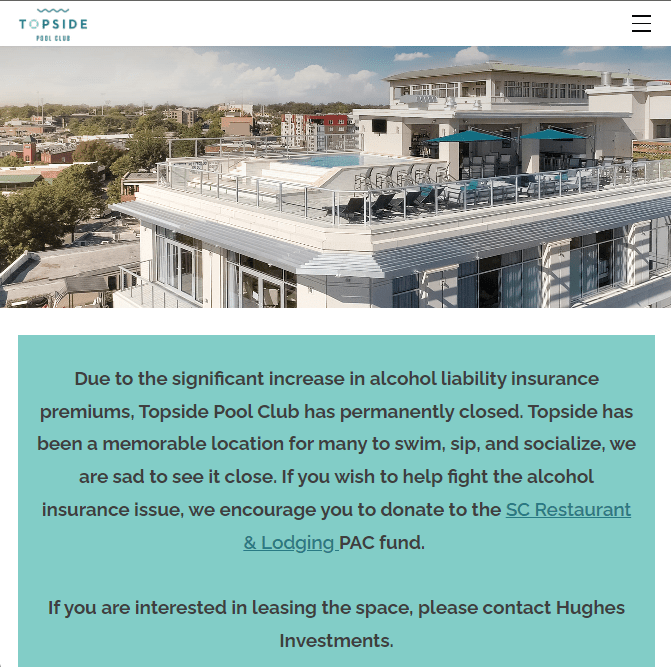

WYFF4 – Palmetto Brothers Dispensary

Another SC brewery, restaurant will close due to liquor liability insurance costs

6.12.24

We just want to clarify a few things mentioned in the podcast so as not to share any misinformation, intential or accidental. The host of Conversation Mill is not expected to know the accuracy of the details presented.

👉 State Rep. Jay Kilmartin stated in 3 press conference’s and the article below that the beer and wine license rate increased from $1,500 to $28,000.

https://www.coladaily.com/business/legislator-jay-kilmartin-rallies-for-liquor-liability-law-reform/article_eb2f2a70-ed35-11ee-a44d-0342853b81d6.html

👉 SC currently has 6 female Senators and 19 female State Representatives.

https://www.scstatehouse.gov/member.php?chamber=S

https://www.scstatehouse.gov/member.php?chamber=H

👉 Senator Shane Massey debated Senator Dick Harpooltian in favor of S.533. (the SC Justice Act) https://youtu.be/le9V0bEnv6k?feature=shared

“This is a call to action,” said South Carolina House of Representative Jason Elliot (R). “Businesses all over South Carolina are closing because of unaffordable alcohol liability insurance.”

“Over the last five to six years, I’ve seen our insurance on average go up, 50%, 60% to 70%,” said Omar, a co-owner of Hall of Fame Sports Grill in Greenville.

It’s a trend that’s been noticed by Salem-based Jocassee Valley Brewing Company as well.

“We were able to find insurance at the last minute comparable to what we had the year prior,” said the Morton, the owner of JVBC. “But when it comes back around, we don’t know what we’re going to face. You know, 50% [and] 75% increases will shut us down, no doubt. Now, we are here in a state that says that it is in support of small business, but I think that we’re are not part of that vision.”“We opened last year and went through the process of licensing and getting insurance,” said the owner of Rock Hill-based Hoppin’ Rock Hill, Joe: “[We were] sticker shocked at our insurance premium last year for our $1 million-$2 million policy that was quoted at $35,000.”

Some people said they don’t question the good intentions of the policy itself; it raises questions of whether the onus of the responsibility should lie solely on the businesses.

“I think the establishment, whether it be a bar or restaurant, should have some liability,” said Doug DeMaria, a frequenter of Hall of Fame Sports Grill. “But let’s be fair, people come to a bar to drink and they have to be held accountable. I hope the public becomes aware of the fact that the insurances are rising in bars and restaurants to the point where they’re going to be put out of business.”

WSPA 7 News –

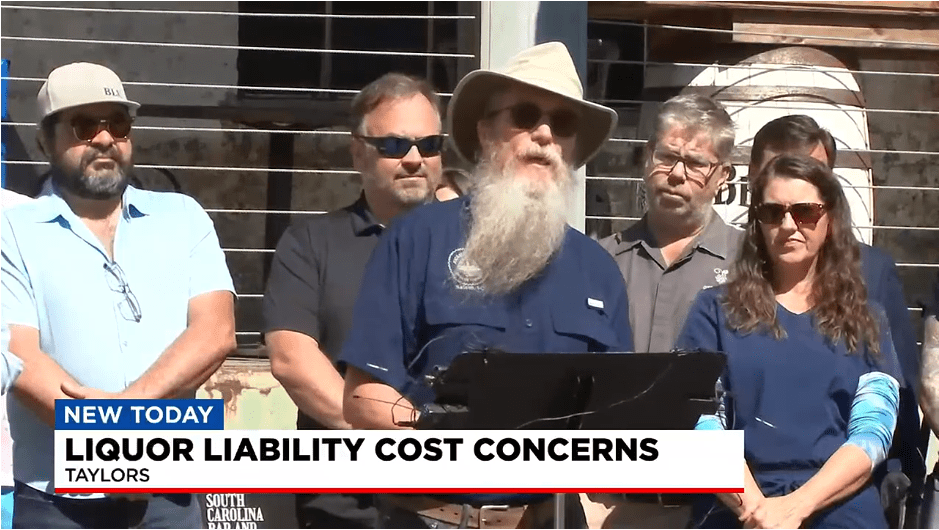

Business owners claim liquor liability law is forcing closures

5.29.24

The problems with liquor liability have been a hot topic across the state and in Columbia for more than a year now.

With a special session coming up in a few weeks, bar owners and some lawmakers see it as an opportunity to address this issue before it’s too late.

Bar owners and lawmakers gathered Wednesday to call on Columbia to take up the issue in a special session in June. This was the first news conference of the newly formed South Carolina Bars and Tavern Association since its creation in mid-May.“I’m calling for the general assembly to amend the sine dine resolution to include liquor liability. We cannot wait till January to get this done. More businesses will be closed,” Rep. Jason Elliot said.

“Look around at all the small places. All the places you call home and get ready to have to go to Red Lobster. That’s right Red Lobster won’t be here either,” one bar owner said.

I Love Ann Show – WCRS 1450AM & 98.5FM

Senator Billy Garrett spouting inaccurate information

5.28.24

“All these venues are fine, if they follow the law.”

“You see this this big crisis is not really a crisis. It’s a manufactured crisis and it’s manufactured by the insurance industry.”Senator Billy Garrett – District 10

Whistle 100 WSSL –

Bill Ellis with Sheila Merck from SC Venue Crisis and Chris Smith from The SC Bar and Tavern Association

5.23.24

Kicks99 Country –

South Carolina Liquor Insurance Requirements – Could Bars Be In Trouble?

5.15.24

For small businesses, “shutting their doors” will be the norm for now.

Fox Carolina –

Liquor liability affects Upstate business

5.16.24

Insurance Journal –

Popular SC Country Music Venue Shuts Down Due to Liquor Liability Insurance Costs

5.16.24

Upstate Business Journal – The Blind Horse’s closure is one piece of a bigger problem in South Carolina 5.16.24

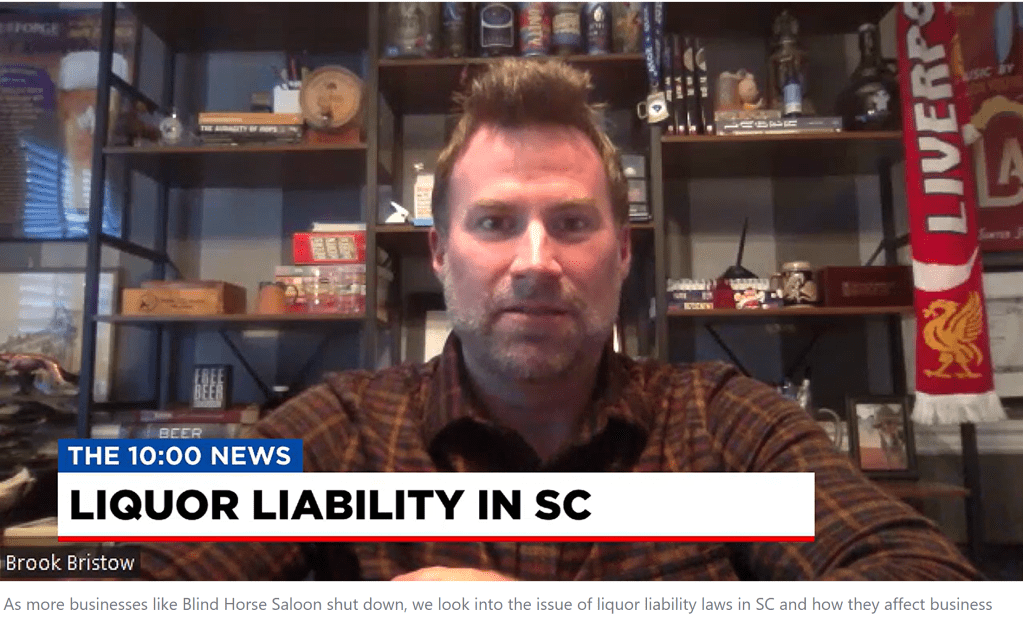

There’s a neon light at the end of the tunnel for a Greenville staple. The Blind Horse Saloon has welcomed customers and country music artists for nearly 30 years. They announced Tuesday they’re closing their doors effective immediately. They blame South Carolina’s current liquor liability laws for the closure.

This week, people have poured one out for the famous music venue and bar. But the Blind Horse is only one part of a bigger problem.

WSPA 7 News – The Blind Horse Saloon closes its doors after nearly 30 years 5.15.24

“It has been a wonderful 29 years,” the nightclub said. “Thank you!”

Kellan Monroe, the owner of Craft & Draft, with locations in Columbia and Irmo, says the future is uncertain for bars.

“Insurance which we’re required to be able to purchase an alcohol license to be able to sell alcohol to the public, that insurance has pretty much quadrupled for us. We’ve paid a bunch off our Irmo location and it’s independent. So now, in both of our locations, it’s our third largest expense that goes payroll, rent, then insurance — and that’s solely to be able to operate,” he said.

Not only is the insurance high, but Monroe says it’s also difficult to find companies that will insure these establishments.

“We’re actually, today, writing a new policy for this store at our Devine Street location and there’s about three companies that do it total right now. It had gone down to two, it went back up at three and then it went back down to two and that’s it. It’s not like you can really shop in an open market. You really just are forced to buy with what they will sell you,” he said.

Current state law requires restaurants that serve alcohol to have a $1 million liability policy, making it difficult to stay afloat.

WLXT News19

Bar and music owners will now have to wait until next year to hopefully get help from lawmakers in Columbia to fix the problems with liquor liability insurance.

Lawmakers ran out of time in this legislative session to address liquor liability issues for venues across the state.

While several bills like the SC Justice Act, the SC Save Our Venues Act, and even a discussion to suspend the $1 million minimum, all looked promising, they all failed to reach Gov. Henry McMaster’s desk.

WXLT News 19 – Senator Dick Harpootlian blocks new business. “I’m not opposed to people drinking, good golly… but another two hours is not going to make or break him.” –

5.11.24

An opportunity to serve alcohol later was the request from Yu Sing Tam, the owner of the property at 742 Harden Street, formerly the ‘Horseshoe’ bar in Five Points. On Thursday, he presented his request and plans for two new restaurants to Columbia’s Board of Zoning Appeals (BOZA), and asked to have the mandatory stop of alcohol sales moved from midnight to 2 a.m.

The proposed change did receive backlash from District 20 Senator Richard, ‘Dick’ Harpootlian.

SandySenn.com – Shared Post & Courier article “South Carolina restaurants insurance politics pawns“

4.23.24

Cola Daily – Legislator Jay Kilmartin rallies for liquor liability law reform

4.15.24

InsuranceJournal.com – SC Bill, Passed by House, Would Let Captives Solve the Liquor Liability Squeeze

4.8.24

The bill, sponsored in part by Rep. Jason Elliott, R-Greenville, would keep the state’s controversial requirement that bars and restaurants maintain at least $1 million in liquor liability coverage. Hospitality groups have said for months that the liability requirement, mandated in 2017, is a big reason behind soaring insurance premiums and a dearth of insurers willing to write that much.

Post & Courier – SC lawsuit reform died with a whimper in the Legislature last week. Here’s how.

4.8.24

Upstate Beer Boys Podcast – The Boys venture down to Piedmont and meet up with Tribble at Tribble’s Bar & Grill and talk about the looming insurance crisis affecting breweries, bars, restaurants and the like here in South Carolina.

3.25.24

Toke Talk Podcast – Tribble, Owner of Tribble’s Bar & Grill stopped by Smokey Bear Hemp Company & Music Holler by for some one on one Toke Talk with Lecretia Ann.

3.5.24

Insurance Journal –

A Look at the Liquor Liability Landscape

3.18.24

“In the RPS writeup, Ward encouraged agents to speak to their clients about reviewing their websites, social media platforms and Yelp reviews to see if what is being presented reflects their operation.

In its report, CRC said agents may help with the affordability of liquor liability coverage by encouraging establishments to review business hours and menu options, and establish rigorous risk management policies. Gathering current information and producing low-touch submissions that tell a story are also key.”

Allen Laman and William Rabb for Insurance Journal

FitsNews.com –

What’s Really Going on with Liquor Liability in South Carolina?

3.5.24

“Small businesses are drowning under South Carolina’s wildly unfair and impractical liquor liability laws. Is a solution in sight?” Diane Hardy, founder of Mom & Pop Alliance of South Carolina, asks that question, plus provides two real world examples of how businesses are being affected with quotes from the owner of Sue’s Wings and Things in Anderson, and the former owner of Rotties 221 Biergarten in Woodruff.

MyNewMarkets.com –

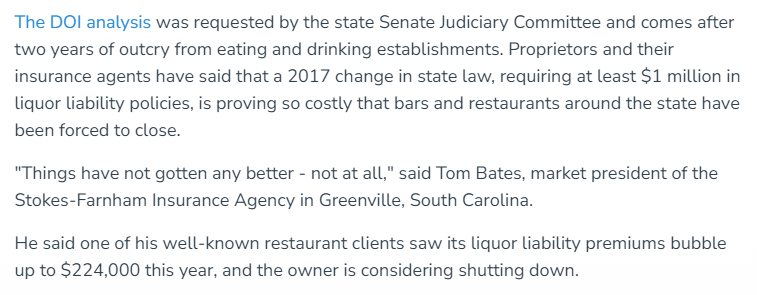

South Carolina Liquor Liability Market ‘Extremely Unprofitable,’ DOI Report Says

2.29.24

“South Carolina is truly an outlier…”

This recent article by William Rabb reinforces what we’ve been telling lawmakers. South Carolina’s small bars, music venues, and restaurants are being crushed by liability insurance rates. But, it’s not the insurance carriers who are truly at fault. Unless S. 533 is passed to correct the wrong done by S. 116 in 2017, this situation will NOT improve.

“The market conditions may be even worse than the (DOI) report shows. Other states, including Georgia and Florida, have made changes to their joint and several liability statutes in the last 24 months – liability limitations that were not reflected in the DOI report, said Russ Dubisky, executive director of the South Carolina Insurance Association.

“Liquor claim frequency and claim severity in South Carolina significantly outpaced surrounding states. The average incurred claim in the Palmetto State was more than $250,000 – double the average for the other states.”

Post & Courier – (Subscription required)

SC lawmakers offer possible solution to bar and restaurant alcohol insurance spike

2.28.24

South Carolina lawmakers are weighing an incentive program to woo insurance companies back into the Palmetto State amid a reported crisis in the liquor liability insurance market that has threatened to shutter hundreds of bars and restaurants across the state.

Whether the House bill does what it intends — or can pass muster in a skeptical Senate — remains an open question.

In South Carolina, any venue serving beer, wine or liquor after 5 p.m. is required to carry a liquor liability insurance policy of at least $1 million.

GoLaurens.com –

Liability laws in South Carolina threaten the health of local businesses

2.28.24

The owner of Palmetto Brothers Dispensary tells it like it is in this article by Melissa Gibson for GoLaurens.com.

“Insurance companies are saying they aren’t making any money in South Carolina, so they aren’t going to offer policies anymore. Everyday we’re finding insurance companies going out of the state and if you do find a couple that will work with you, the rates are astronomical,” Meetze said. “It’s really day to day whether we’re able to survive or not.”

SC Policy Council –

SC bars are getting crushed by liquor liability insurance bills. Is there a solution?

2.24.24

“A bill under consideration by House lawmakers would establish a public option for liquor liability insurance, backed by South Carolina taxpayers. It would also offer special reductions to the current $1 million policy requirement – but only for businesses that agree to close early, limit drink specials, or meet other requirements. ” – Written by Sam Aaron

February 24, 2024

Post & Courier (Subscription Required) –

SC bars are getting crushed by liquor liability insurance bills. Is there a solution?

2.26.24

Caption from P&C Instagram: About 10,000 people have signed a SC Venue Crisis petition calling for legislative change that would alleviate the burden of rising liquor liability costs. But on Feb. 20, a mild, sunny day, a group of just under two dozen people, ranging from insurance agents to brewery and restaurant owners, gathered to call on the state’s leadership to reform lawsuit legislation.

Read about what business owners are calling a crisis, as well as their reform efforts. (Photos by Henry Taylor, Eden Prime/Special to The Post and Courier)

The State –

Fewer bars, restaurants will serve alcohol in S.C. unless this state law changes

2.21.24

Fox Carolina –

Calls to change liquor liability law

2.20.24

Charleston City Paper – Bar owners struggle as legislators search for solutions

2.18.24

WLTX News19 – SC legislators consider changes to liquor liability insurance amid rising costs

2.16.24

StateHouseReport.com – BIG STORY: Bar owners struggle as legislators search for solutions

2.16.24

NewsFromTheStates.com – Bar owners say insurance costs are driving them out of business. Legislators consider changes.

2.15.24

Post and Courer (Subscription Required) – How much is too much? SC bartenders caught in crossfire of liquor liability debate

2.12.24

FoxCarolina- Liquor liability license

2.1.24

InsuranceJournal.com – South Carolina Liquor Liability Market ‘Extremely Unprofitable,’ DOI Report Finds

1.11.24

Lexington County Chronicle – Restaurant owners strategize around rising insurance rates, seek help from SC lawmakers

1.10.24

WSPA 7 News – Greenville Chamber releases statement on liquor liability costs in the Upstate

1.8.24

The cost of liquor liability is putting tremendous pressure on the Upstate’s important tourism and hospitality sector. The skyrocketing costs of insurance – on top of the significant inflationary pressures already hurting small businesses – will have far-reaching effects on hundreds of small businesses if it is not corrected quickly.

Every small business in South Carolina is one lawsuit away from going out of business because we have a system where a business might be 1% at fault but could he held 100% financially liable. Legislation that will solve both issues was filed last session by Senate President Alexander (S. 533) and supported by nearly every Republican leader in the state Senate. The message from businesses across the Upstate is clear: The General Assembly must act quickly in 2024 to address the unfair legal liability burden and the higher costs to business that have followed years of inaction.

This issue has been a major agenda item for the Greenville Chamber and the Upstate Chamber Coalition for nearly a decade. Providing this relief to small business owners is at the top of our legislative agenda for 2024 and further delays in solving this issue will result in more business closures and an unnecessary drag on the Upstate’s economy.

– GREENVILLE CHAMBER

Greenville Journal – Skyrocketing insurance costs are closing bars, businesses. Will SC act in 2024?

1.4.24

Fits News- VIDEO

State Lawmaker Addresses S.C. Venue Crisis

12.13.23

WYFF News 4 – South Carolina bar tears out bike track after liquor liability insurance triples

12.8.23

WXLT News19 Columbia breweries say they face challenges in South Carolina

12.7.23

Post and Courier (Subscription Required) – High insurance is threatening SC’s restaurants and nightlife. Lawmakers want to investigate

12.7.23

Live 5 WSCS – Rising liquor liability prices spark concerns across SC

12.1.23

Post & Courier (Subscription Required) They aren’t bars but, SC’s liquor liability law threatens Greenville businesses too

11.29.23

Lexington Chronicle (Subscription may be required) West Columbia biergarten says it could close if insurance crisis continues

11.15.23

News7 WSPA Spartanburg Memorial Auditorium to serve alcohol again

10.26.23

News2 – Charleston High liquor liability policy hurting some Isle of Palms bars

9.20.23

Live5 WCSC – The other side of rising liquor liability rates: Impact on victims

9.20.23

Post & Courier Charleston (Subscription Required) Letters: Rising liquor liability rates need reform

9.20.23

Post & Courier Charleston (Subscription Required) IOP veterans organization reopens following liability insurance-related temporary closure

9.20.23

ABC4 News Lowcountry hangouts feel the impact of liquor liability laws 9.19.23

InsuranceJournal.com – South Carolina Bars, Eateries Closing Down for Lack of Affordable Liability Coverage

9.19.23

Post & Courier (Subscription Required) Commentary: Changing SC liquor liability laws will hurt victims of drunken drivers 9.19.23

Post & Courier Letters: Tough to gauge drinkers’ sobriety levels 9.15.23

Conversation Mill Podcast

Liability Laws- Could They Impact Your State Next? 9.13.23

Post and Courier

Editorial: We can help responsible bar owners without gutting anti-DUI law 9.13.23

Post & Courier Charleston

‘It’s not sustainable’: SC bars, venues are closing amid rising liability insurance rates 9.9.23

Post & Courier Greenville

The Spinning Jenny is closing. Owners explain why they are shutting down Greer music venue. 9.1.23

Post & Courier Columbia (Subscription Required) SC businesses call for liability insurance reform as premium rates 8.14.23

Lexington Chronical Editorial: Saving SC bars isn’t worth gutting one of best anti-DUI laws 8.10.23

Upstate Business Journal SC bars reach ‘crisis point’ with skyrocketing liability insurance rates 8.3.23

Post & Courier Charleston (Subscription Required)

Charleston brewery hosts town hall event supporting liquor liability insurance reform 8.3.23

MyrtleBeachSC.com Insurance costs soar. NMB Chamber sponsors resident/business meeting with Insurance Commissioner 8.2.23

MyrtleBeachSC.com

Boathouse, Handleys, House of Blues, others at risk of closing from Luke Rankin’s liability law 6.21.23

MyrtleBeachSC.com –

Town Hall Held In Littler River to Combat Sen. Rankin’s Attack on Local Businesses

6.22.23

MyrtleBeachSC.com –

MBACC no shows Merchant Town Hall. Businesses concerned over skyrocketing insurance costs 6.27.23

WSFA 12 News Alabama business advocates pushing for more specific liquor liability laws 4.11.23

SC Policy Council –

Two bills would reduce unfairness in SC’s civil liability system

3.2.23

A pair of House and Senate bills filed in February would move South Carolina’s civil liability laws in the right direction and a foster a legal environment that is fairer to businesses and more conducive to economic growth.

The bills (S.533 and H.3933) would require juries or judges to consider nonparties in addition to defendants when determining fault in civil cases. Current law does not permit juries or judges to consider the liability of nonparties when assigning fault percentages, even if they were partially responsible for an incident. – Written by Bryce Fiedler

March 02, 2023

Leave a comment