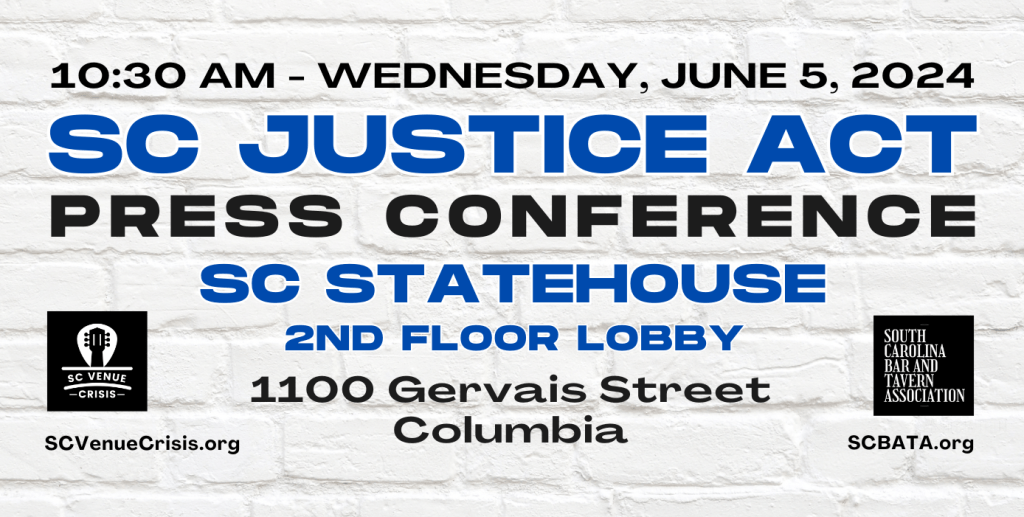

The House Judiciary Liquor Liability Ad Hoc Subcommittee met on February 27, 2024 to amend H. 5066, the Fair Access to Insurance Requirements Act, which passed unanimously. It still needs approval from the full House of Representatives before moving to the Senate, and then possibly to the Governor’s desk.

Two significant amendments to H. 5066 concern risk mitigation. Previously, an establishment would be required to stop serving alcohol at 10:00 pm. That time is now midnight. The original act offered a discount for companies with no more than 30% of total sales from alcohol, which has be increased to 40%.

The video below shows the entire meeting with questions, comments, and the roll call (vote). Read H.5066 and the fiscal impact report for yourself and let us know what you think.

Below is a transcript of Rep. Jason Elliott reading H. 5066 to the subcommittee.

The Back Story

In 2017, Act. 45 was signed into law which maintained that any establishment selling alcohol for on-premises consumption after 5 p.m. was required to have a liquor liability policy, at least $1,000,000 in coverage. The Department of Insurance reported last time that insurance companies in South Carolina are spending almost $3 on claims and expenses for every dollar they collect in premiums, which I think by any stretch of imagination that’s massive and that math doesn’t work.

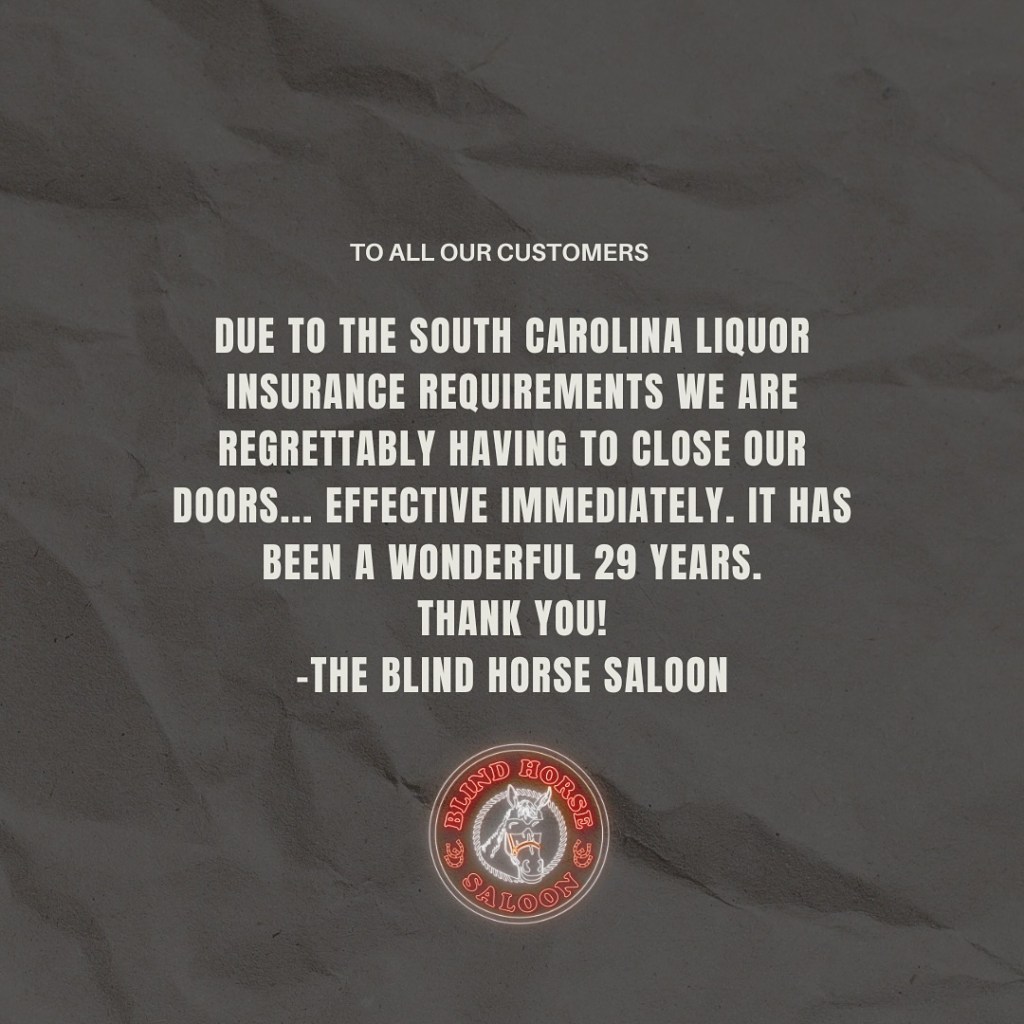

This has led many insurance companies to significantly raise insurance rates on their customers, while other insurance companies have chosen to get out of the market altogether in South Carolina. Responsible business owners have seen the cost of their insurance premiums rise significantly, despite never having a claim filed against them. Some small business owners have permanently closed their doors because they can’t afford to increase in premiums.

H. 5066

What this bill and this amendment seeks to do is provide immediate relief in those premiums in two ways.

First, the bill is going to be proposed to amend, provides incentives for businesses who carry this type of insurance to mitigate the risk associated with on-premises consumption of alcohol. This can be done in a combination of ways.

- An establishment that stopped selling alcohol (at midnight) would be able to reduce their insurance coverage by $100,000. In that instance, the coverage would be $900,000 if they stopped serving alcohol by midnight.

- There would be additional drops in coverage for each hour that the establishment stops selling alcohol. For example, an establishment that stopped serving alcohol at 6 p.m. would only need $300,000 in coverage.

- The bill as we proposed to amend, contains an alcohol server training program in businesses that if the business requires their employees to complete the training, the establishment would get another $100,000 reduction in their coverage.

- Same would apply for a $100,000 reduction in coverage if less than 40% of the business’s sales was based on alcohol.

- Tax exempt nonprofits and single event permit holders would be required to have $500,000 in coverage as opposed to 1 million.

- A business can take advantage of some or all of these mitigation factors. But under the bill, as we’re going to propose to amend, would maintain that the businesses would have to have at least $250,000 in coverage.

- So if they take advantage of all the mitigation factors, it would go from what the 1 million now possibly down, but no less than $250,000.

- The bill also requires private insurance companies to establish liquor liability mitigation measures and offer premium discounts to businesses that comply with those mitigation measures. This is similar to how we handle homeowner’s policies within our state code.

The second way this bill helps to ease the stress on the insurance market is to create a program within the Department of Insurance that provides access to liquor liability insurance coverage to those who choose to purchase policies from outside the traditional market. The Department of Insurance can try and contract with a private entity to administer the program, and the program will be overseen by an 11 member board of trustees.

- 3 appointed by the governor

- 3 by the House

- 3 by the Senate

No member of the General Assembly would be able to serve on the board. The director of the Department of Insurance and the chief of SLED would also serve as ex-officio directors.

Two funds would be created under the amendment within the Department of Treasury, the Fair Access to Insurance Fund and the Liquor Liability Victims Compensation Fund. Those funds will be required to administer the program.

The Fair Access to Insurance Requirements Fund will be initially funded through a one time loan from the Insurance Reserve fund. The loan will be repaid by the Fair Access to Insurance Requirements Fund at an interest rate equal to the RIF’s annual rate of return of investments. To make the IRF whole in this process. Additionally, $5 million of the liquor by the drink tax would be remitted annually to the Liquor Liability Victims Compensation Fund.

The annual contribution of $5 million will support the program and assure funds that are available for victims claims. This bill also ensures that the annual $5 million contribution from the liquor by the drink tax will sunset and will therefore not always be required. That would be timed with when the loan is repaid. The $5 million contribution from the liquor by the drink tax would stop being put into the program.

The bill also increases the assessments charge to persons convicted of driving under the influence, the UAC and felony DUI by requiring an assessment for those convicted of those offenses of $88. This additional assessment will be distributed to the Liquor Liability Victims Compensation Fund to support the program and ensure funds are available for victims claims. We also have a provision clarifying that captive insurance applies to liquor liability.

Captive is when some are businesses groups to band together to self-insure. While the law has been silent on that, this explicitly makes it clear that captives may engage in the business of liquor liability.

Leave a comment