When the SC Venue Crisis team began “making noise” on April 20, 2023, we looked wherever we could for information and inspiration. One shining ray of hope came from Alabama. Act No. 2023-25 was signed into law by Gov. Kay Ivey just one day before.

As stated in an article by the Alabama Retail Association, “The intent of Alabama’s new standard for liquor liability was to drive down the cost of liability insurance for Alabama’s hospitality industry.”

“The new law creates a standard under which a server would have to knowingly serve a visibly intoxicated person and for that service to be the proximate cause of an injury or death for the business to be liable. This common-sense reform calls for increased personal responsibility in situations where damages occur due to the overconsumption of alcohol. The standard also aligns with what other states require.”

Alabama Act. 2023-25

So, where can we get some of that common sense reform?

That standard may align with some states, but not South Carolina. Here, common sense is not a flower that grows in everyone’s garden. Snakes chase payouts of 30% or more from defendants who may have only 1% of fault in an incident but could be forced to pay up to 100% of a claim.

Rep. Stewart Jones submitted a bill, H.4529, in June of 2023 and named it the SC Save Our Venues Act. He modeled it after the Alabama Dram Shop Act.

Throughout the summer and into the fall, he met with our team to hear our recommendations, discuss potential wording for amendments to the bill, and manage our expectations for the upcoming legislative session. Rep. Jones has continued supporting our cause, informing us of upcoming meetings, discussions, and proposed legislation. As of the writing of this blog post, H. 4529 has yet to get any traction in the House of Representatives.

To date, four other acts of legislation concerning liability insurance for South Carolina are up for discussion.

S. 1048 is a new one! The summary reads, “Illegal Furnishing of Alcoholic Beverages Liability,” but that’s only one part of it. Let’s look at the wording.

(B) A licensee that sells, serves, or otherwise furnishes alcohol to an individual who is at least twenty‑one years old shall only be civilly liable to a third party for actual or punitive damages arising out of the sale, service, or furnishing of alcohol to that individual if:

(1) the licensee knew or should have known that the individual was visibly intoxicated at the time of the sale, service, or furnishing of the alcohol; and

(2) the individual’s intoxication was a proximate cause of bodily injury, death, or property damage to the third party.

(C) A licensee that sells, serves, or otherwise furnishes alcohol to an individual who is less than twenty‑one years old shall only be civilly liable to a third party for actual or punitive damages arising out of the sale, service, or furnishing of alcohol to that individual if the individual’s intoxication was a proximate cause of bodily injury, death, or property damage to the third party.

(D) Upon the death of any party, the action or right of action authorized by this section will survive to or against the party’s personal representative.

So, the establishment that has a license to sell alcohol can be sued by a third party if…

- a bartender knowingly serves a visibly intoxicated person

- that person leaves the establishment and injures someone, regardless of how many other establishments they visit before an accident occurs (no change there).

- if the bartender serves someone under the age of twenty-one

Where is part (E)?

In the Alabama law, part (E) states “Nothing contained in this section shall authorize the consumer of any alcoholic beverage to recover from the provider of the alcoholic beverage for injuries or damages suffered by the consumer caused by the consumer’s ingestion of alcohol.”

WHY would they not include that vital portion?

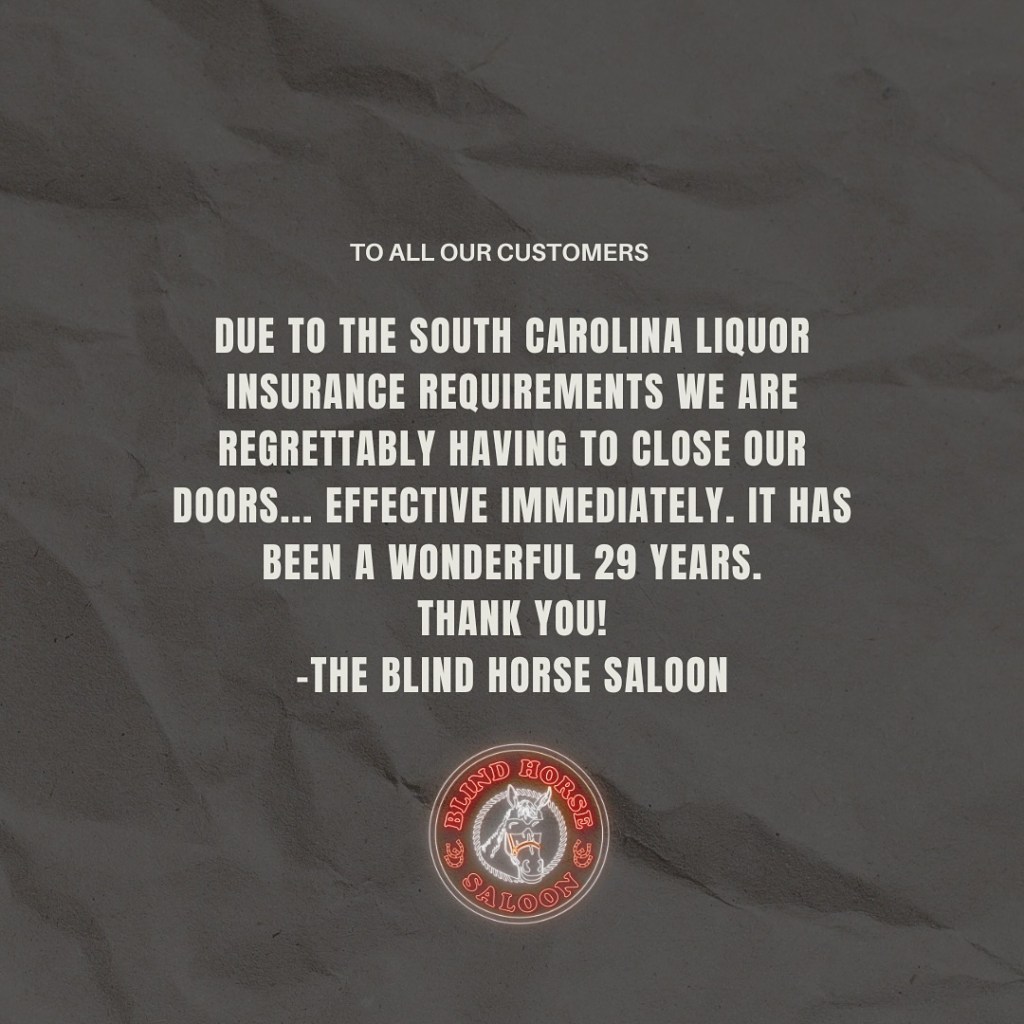

And, if it weren’t for a phone call I received from an Alabama business owner on Thursday, February 15, I may have been happier to see them. The caller informed me that he had just received a termination letter from his insurance carrier. Now, he’s frustrated and feeling defeated, scrambling to find affordable liability insurance for two businesses.

S. 1048 must be amended!

Alabama attorney Fob James knows why.

“Rather than require plaintiffs to litigate whether a bartender acted reasonably, plaintiffs need only show that the injury occurred “as a consequence” of the intoxication. This stricter standard means it doesn’t matter whether the bartender was reasonable or not. It also means an intoxicated patron’s own negligence has no bearing on the establishment’s liability.”

M. Jansen Voss represents restaurants, bars, breweries, and hotels in Dram Shop lawsuits. Here’s his take.

“Ostensibly, the new legislation makes it harder to sue restaurants and bars for dram shop claims, thereby lowering the risk of exposure, and in turn, lower dram shop insurance premiums.

Plaintiff lawyers don’t really care about causation. If they can get their case in front of a jury, they gloss over the proximate cause element and focus on a defendant’s violation of rules, and the plaintiff’s injuries, pain, and suffering. So, changing the causation standard from “consequence of” to “proximate cause” is nothing more than a superficial academic change in the law.”

” …a real pro-small business move would be to remove dram shop insurance coverage requirements altogether. Eliminating state-mandated insurance requirements and passing a statute similar to Louisiana’s dram shop statute, would decrease dram shop insurance premiums for local restaurants and bars. However, Alabama plaintiff lawyers won’t let that happen. They’re not happy with the current $100,000.00 single-limit coverage requirement, but $100,000.00 is better than nothing. And, a dram shop statute like Louisiana’s statute would all but eliminate dram shop claims in Alabama…”

Who do we know in Louisiana? Let’s get THEM on the phone and hear how it’s going down there, because after speaking with the Alabama business owner and reading S. 1048, I am afraid for the venues we’ve been working so hard to support and wonder what the exact wording needs to be to bring insurance carriers back to South Carolina and save our small businesses.

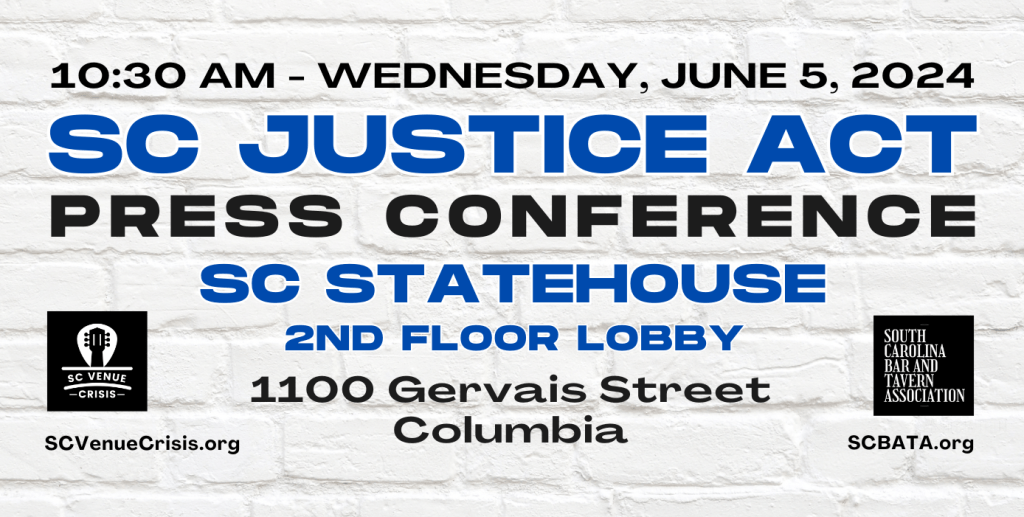

The House and Senate subcommittees each meet this week to discuss liquor liability.

The House Judiciary Liquor Liability Ad Hoc Subcommittee will meet Tuesday, February 27 at 10:00 am in room 516 of the Blatt Building to vote on H. 5066, the “Fair Access To Insurance Requirement” Act. Watch the meeting here.

We have mixed feelings about this act. The bill would create a public fund for businesses required to carry liquor liability insurance and reduce the mandated amount of coverage if a business:

- closes by 10 pm

- requires alcohol server training

- requires scanners, cameras, and limits on drink specials

- can show that less than 30% of its total profit is from alcohol sales

- is a nonprofit organization

- is an entity engaging in a single event

Other than the obvious issues of closing by 10 pm and the requirement of no more than 30% of sales resulting from alcohol, there is one glaring omission.

H. 5066 does nothing to protect businesses from frivolous lawsuits.

On Wednesday, February 28, you can watch the Senate Judiciary Subcommittee meeting at 11:30 am in Room 208 of the Gressette Building. According to the agenda, they plan to discuss S. 533, S. 844, and S. 1048.

We’ve been promoting S. 533, the SC Justice Act, for nearly a year. In the simplest of terms, it “modernizes the way South Carolina’s liability laws work to ensure businesses are only responsible for paying damages equivalent to their share of fault in civil lawsuits.” – scclr.org

S. 844 is Senator Luke Rankin’s idea for a committee to research coverage availability, premium rates, and deductibles. The committee’s report would be due by January 31, 2025. Rankin and the chair of the Senate Judiciary Subcommittee, Senator Gerald Malloy, authored the 2017 bill that mandated the $1 million liability coverage, which helped create our situation. So, in our eyes, this is a stall tactic.

Whether you’re a fan of live music, nightlife, socializing with your friends over an alcoholic beverage at your favorite tavern, or someone who simply supports small businesses, we hope you will contact your legislators THIS WEEK!

Ask them to amend S. 1048 and H. 5066. We appreciate their efforts to find a solution to the lack of access to affordable liability insurance, but we also need to protect our businesses. We need true common sense legislation.

Sheila Merck

Director of Operations and Communications

SC Venue Crisis

Show your support!

By making a contribution, you will help us keep this campaign going!

Email us at scvenuecrisis@gmail.com with your suggestions or to volunteer.

Leave a comment