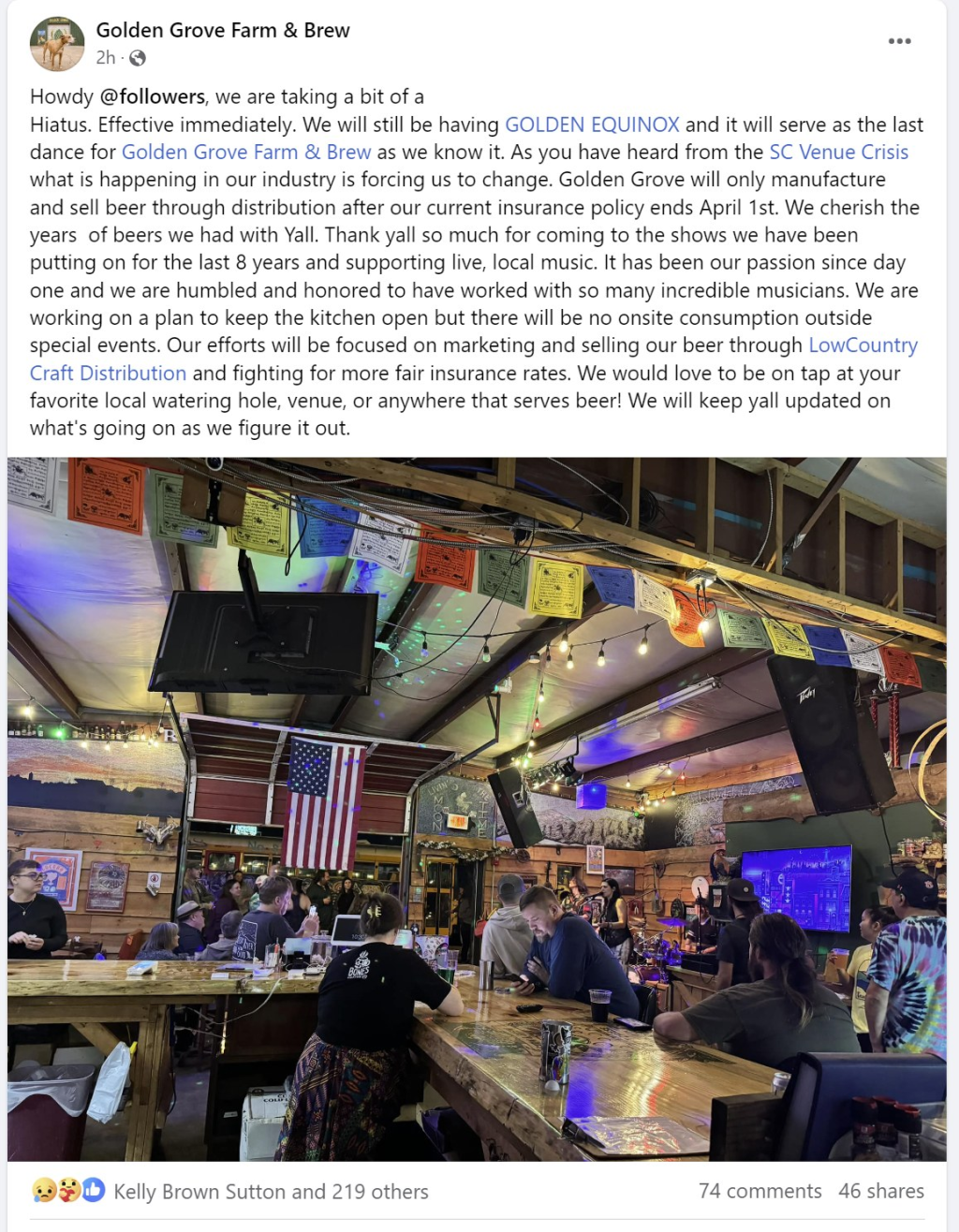

Golden Grove Farm and Brew announced Friday, February 9, 2024 that they are “taking a bit of a hiatus. Effective immediately.”

We hate to see any venue close, especially one with the charm and musical offerings Golden Grove has brought to the Upstate for the last few years. Their Facebook post started the type of dust-up we hope would happen whenever a business announces its closing. Their patrons who haven’t heard about the issues that liability insurance rates are causing small businesses are now in “let’s take action” mode.

HELL YEAH! LET’S DO SOMETHING!

In an effort to provide the most thorough information possible, we’ve updated what used to be our “town hall script” plus added vital details about The SC Justice Act and the new “Fair Access To Affordable Insurance Act. Hopefully, all of your questions will be answered. If not, email us at scvenuecrisis@gmail.com.

WHO ARE WE?

We are a group of concerned citizens who want South Carolina’s small businesses to STAY in business. We are calling on our music and bar community to contact their legislatures to support and pass S. 533, “The SC Justice Act.”

WHY IS THIS IMPORTANT TO THE MUSIC AND BAR COMMUNITY?

“Current South Carolina law can leave a defendant on the hook for all damages in a lawsuit regardless of their percentage of fault.” *

Imagine a person having mimosas with a friend at brunch, followed by beers at their favorite brewery, wine with dinner, and shots at a music venue on the same day. If that person is involved in an accident on the way home, each of the businesses they visited during the day would be equally liable in a lawsuit.

Considering that SC law requires each establishment that sells and serves alcohol for consumption on-premises after 5 pm to have a minimum of $1 million liquor liability or general liability insurance coverage, the attorneys can sue each business for at least $1 million.

This system adversely impacts businesses – including small businesses that cannot survive a hefty lawsuit – leading to increased premiums, reduced availability of insurance coverage, and a target on entities that are perceived as having “deep pockets.” *

It’s not about justice for the victim. It’s about greed.

We’re not talking about the insurance companies. Attorneys are eager to sue the establishments that sell alcohol, and why wouldn’t they be? The attorneys receive 30-40% of the settlement payout. They get their cut before the doctor’s bills are paid. Whatever is left goes to their client, the victim of the accident.

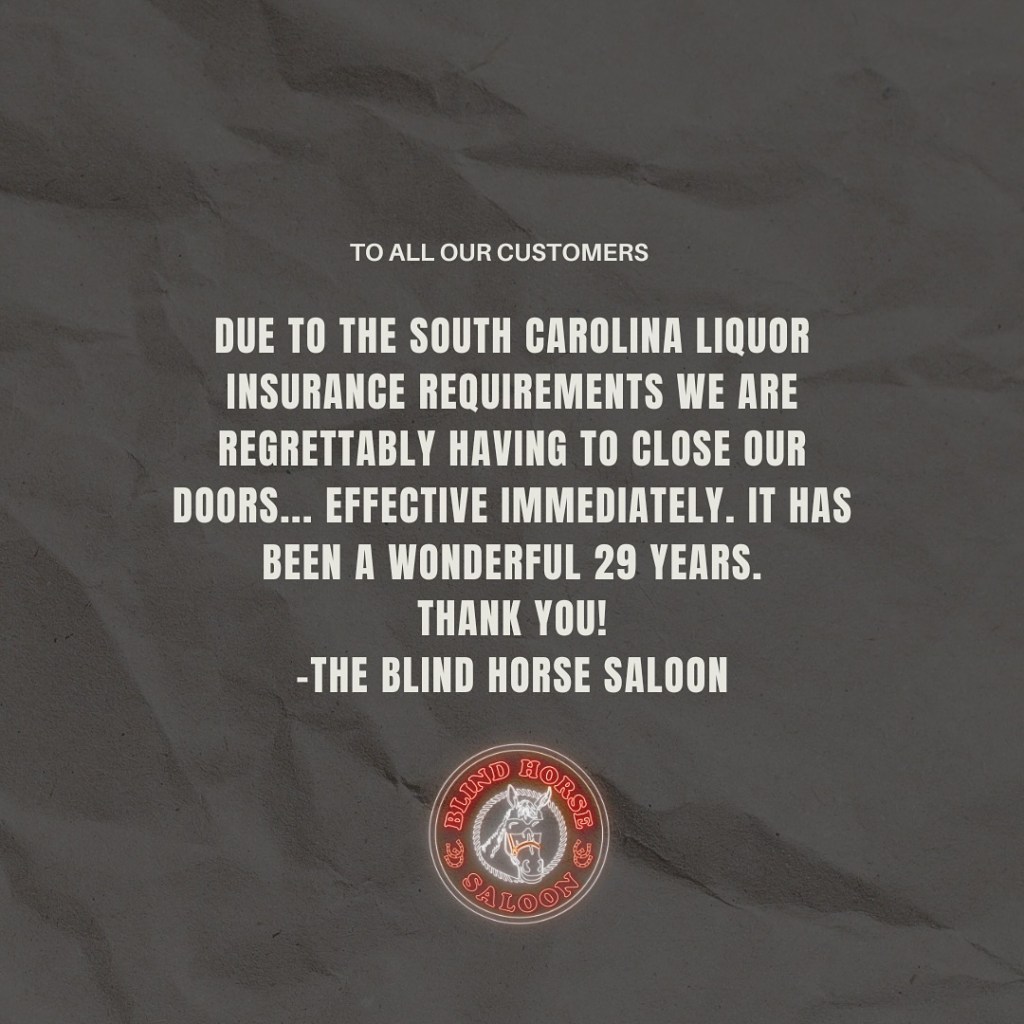

INSURANCE CARRIERS REFUSE TO DO BUSINESS IN SC.

In a report released by the SC Department of Insurance on January 5th of this year, DOI director Michael Wise wrote that “the insurance industry has been extremely unprofitable” over the last six years.

From 2017 to 2022, insurers lost about $1.77 for every $1 premium earned on liquor liability policies. In the worst of those years, carriers lost as much as $2.60 for every $1 premium earned.

How can they afford to do business in a state as “sue happy” as ours? They can’t. At this point, only some companies are willing to sell liquor liability insurance in SC. To cover the inevitable payouts, they’ve increased their rates. Unfortunately, many small music venues, bars, restaurants, and other businesses can’t afford the premiums.

YOU HAVE TO PAY TO PLAY!

Now, we understand why this is important to the music and bar community. (Finally, right?) As you probably suspected, everything is about money.

Let’s say the business owner, whose insurance cost $5k in 2017, is now paying $50k. They know how to pass the cost on to their patrons. The price of food and drinks goes up. But that can only help so much. People will only PAY SO MUCH for a beer, y’all.

NOT-SO-FUN FACT: Cutting the things below will save businesses money on insurance.

- Live music

- Dance floor

- Jukebox

- Pool tables

- Dartboards

- Cover charge

- Security

AGAIN, WHY is this important to the music and bar community?

For venue owners/talent buyers, it’s a matter of supply and demand. Some venues will close, we’re seeing it happen. The venue owners paying increased insurance rates to stay open will have fewer dollars to allocate to live music. That means competition for the gigs will increase while the payout decreases. Musicians willing to travel will have to widen their radius, increasing the competition for gigs in other regions and potentially resulting in less payout due to lower name recognition.

Think about the folks whose work is directly related to the music and bar community.

- Venue & Bar Owners / Staff

- Musicians / Performers

- Photographers / Videographers

- Merchandise Companies / Graphic Designers

- Beer / Liquor / Restaurant / Hospitality Industry Employees

- Restaurant and Bar Owners

- Wedding Venue Management

- Beer, Wine, and Liquor Vendors/Reps

- Brewery Management/Staff

- Liquor Store Owners

- Foodservice Reps

- POS Company Reps

- Arcade Game Vendors

SC businesses are struggling. We need the Senate to move S.533 from the subcommittee to the General Assembly and pass the bill before this session ends in May. If not, thousands of families could lose a portion of their household income while waiting for our legislators to return to Columbia next January.

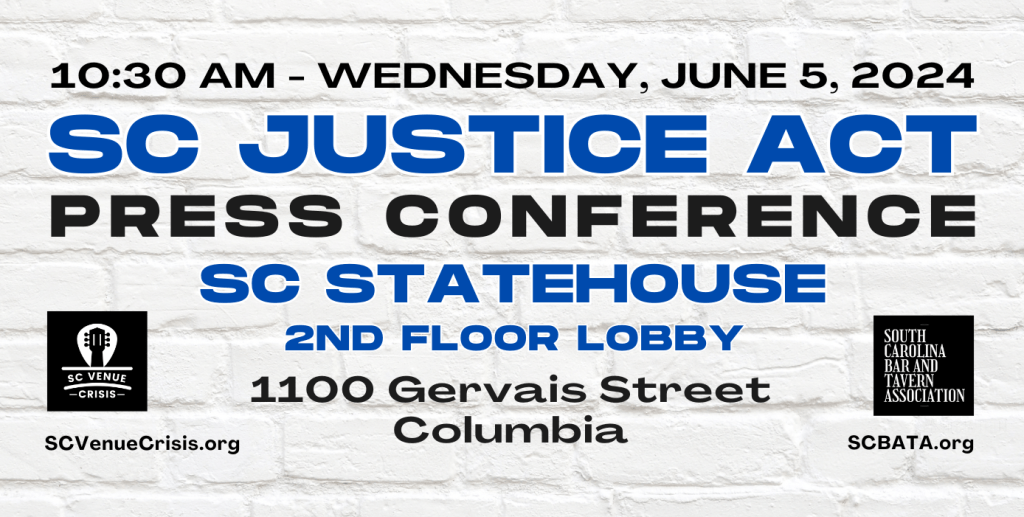

Since May of 2023, the SC Venue Crisis team has held town hall meetings across the state to raise awareness of this issue. We have spoken with various associations, organizations, alliances, and agencies. We’ve been building relationships and learning as much about the process as possible in the time we have. (We have full-time jobs.)

WE NEED THE SC JUSTICE ACT.

“In February 2023, the South Carolina Senate introduced legislation to reform the Palmetto State’s unfair civil liability laws. The bill, S. 533, titled The South Carolina Justice Act, modernizes the way South Carolina’s liability laws work to ensure businesses are only responsible for paying damages equivalent to their share of fault in civil lawsuits.

The bill, long advocated for by South Carolina’s business community, is critical to ensuring that South Carolina remains competitive in recruiting and retaining job creators in the state while continuing to protect injured South Carolinians.

A companion bill, H.3933, has been introduced in the House by Representative Mark Smith. The bill has 45 sponsors and has been referred to the House Judiciary Committee.”

* Quote from SCLawsuitReform.com

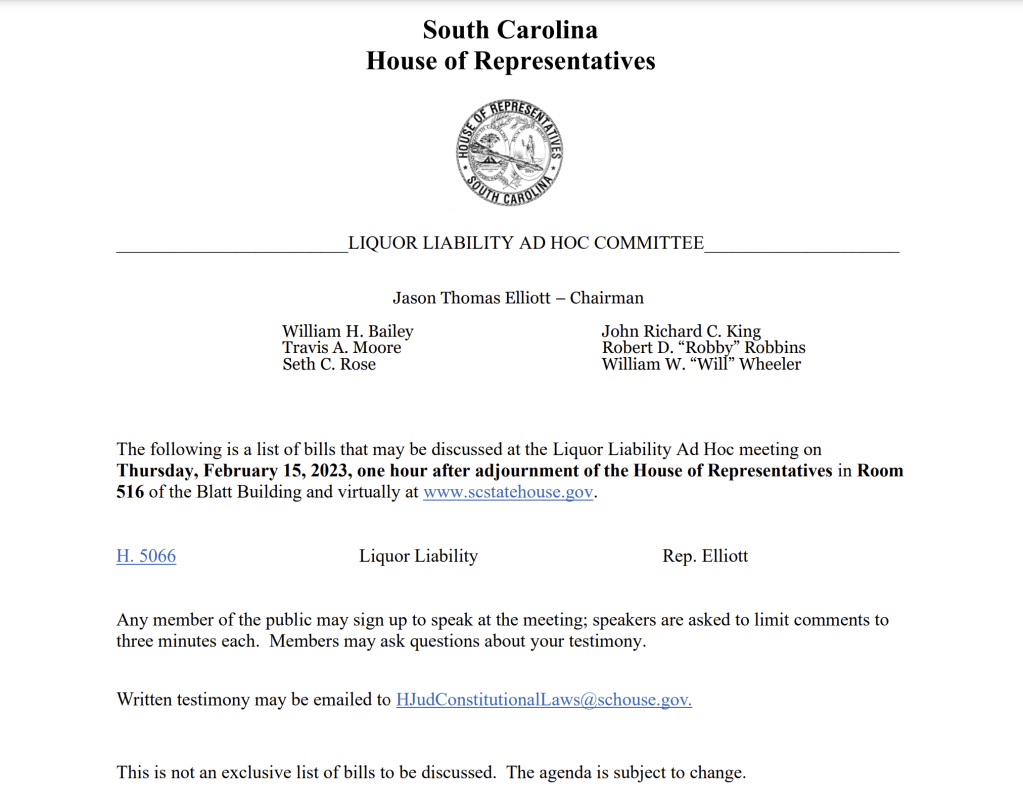

Both the House and Senate have referred the bill to subcommittees. The House meeting was productive (see H.5066). However, the Senate subcommittee was more of an inquisition of DOI Director Michael Wise, who was there to present the information the committee had requested in March of 2023. There’s another one this week that we HOPE will have a better outcome.

Below is a list of the subcommittee meetings that we are aware of.

- January 7 – House Liquor Liability Ad Hoc Subcommittee meeting

- January 31 – Senate Judiciary Subcommittee on S.533 and S.844

- Video archives are available via the link below. Search by meeting date. https://www.scstatehouse.gov/video/archives.php

- February 13 – Senate Judiciary Subcommittee on S.533 and S.844

Gressette Room 105 – 3:00 pm or an hour upon adjournment

WATCH THE LIVESTREAM (Note: This link will not work after the original streaming date. Use the archive link above..) https://www.scstatehouse.gov/video/stream.php?key=13839&audio=0

- February 15 – House Liquor Liability Ad Hoc Subcommittee meeting to discuss H. 5066 one hour after adjournment of the House of Representatives in Room 516 of the Blatt Building

DO NOT BE MISLED.

On February 8, 2024, H.5066, the “Fair Access To Affordable Insurance Act,” was submitted to the SC House of Representatives. This bill aims to address the issue of limited access to affordable liquor liability insurance by creating a state-backed program with specific funding and oversight mechanisms.

Businesses could save money if they qualify for “liquor liability risk mitigation.” However, it does nothing to ensure businesses are only responsible for paying damages equivalent to their share of fault in civil lawsuits.

Take a look.

“For the purposes of this section, the term “alcoholic beverages” means beer, wine, alcoholic liquors, and alcoholic liquor by the drink as defined in Chapter 4, Title 61, and Chapter 6, Title 61.

(E) A person licensed or permitted to sell alcoholic beverages for on-premises consumption, which remains open after five o’clock p.m. to sell alcoholic beverages for on-premises consumption, may qualify for liquor liability risk mitigation if such entity:

(1) closes by ten o’clock pm. A person meeting the requirements of this item may reduce the required annual aggregate limit by one hundred thousand dollars, and an additional one hundred thousand dollars for each hour earlier until six o’clock p.m.; or

(2)(a) completes an alcohol server training course approved by the Department of Insurance;

(b) meets the requirements set by the Department of Insurance to limit the risk to the public, which may include identification scanners, cameras, and limits on drink specials;

(c) closes by ten o’clock p.m.; and

(d) has less than thirty percent of its total sales deriving from alcohol sales; or

(3) is a nonprofit organization, or the entity is engaging in a single event for which a Beer & Wine Special Event License or Liquor Special Event Permit is obtained.

A person meeting the requirements of items (2) or (3) may reduce the required annual aggregate limit by five hundred thousand dollars.”

We need the SC Justice Act and

WE NEED A TARGETED ATTACK.

SC Coalition for Lawsuit Reform is a group of lobbyists for various SC industries. They’re the veterans in this fight. They know who is on our side and who’s just blowing smoke. According to them, we need to target the Senators below IMMEDIATELY. (That means we need people in each of their districts to contact them.)

Tom Young – Aiken County

tomyoung@scsenate.gov 803-212-6000

Attorney, Young & Thurmond, LLC

Scott Talley – Greenville and Spartanburg Counties

scotttalley@scsenate.gov 803-212-6048

Talley Law Firm, PA

Stephen Goldfinch – Charleston, Georgetown, Horry Counties stephengoldfinch@scsenate.gov 803-212-6172

Attorney, Boyd Goldfinch, LLC

Luke Ranking – Horry County

lukerankin@scsenate.gov 803-212-6610

Rankin & Rankin, PA – Chairman of the Judiciary Committee

Brian Adams – Berkeley, Charleston, Dorchester Counties brianadams@scsenate.gov 803-212-6056

Retired Police Officer/Co-owner, Tri-County Appraisals

Michael Johnson – Lancaster and York Counties

michaeljohnson@scsenate.gov 803-212-6008

Attorney, Michael Johnson PC & Associates

Billy Garrett – Abbeville, Greenwood, McCormick & Saluda Counties billygarrett@scsenate.gov 803-212-6032

Attorney, The Garrett Law Firm PC

ADDITIONAL INFO: Bill 116, passed in 2017, requires businesses selling and serving “liquor by the drink” for on-premises consumption to carry a minimum of $1 million in liquor liability or general liability insurance coverage.

- In 2017 the average price of liability policy rates was $5,000 – $6,000.

- By 2020, the average policy rate was $20 – $25,000.

- Today, small music venues and bars struggle to find rates lower than $60,000.

- Some bars can’t find rates under $100,000, even without a single claim on their policy.

- Imagine your car insurance being multiplied 12-20 times in 5 years. Think about how you would cope with that.

EXAMPLES OF RATE INCREASES

- On The Rail Bar & Grill – insurance went up from $3,000 to nearly $16,000 with no incidents and no claims!

- Ridgeville Road House – Was $198 monthly. Now $1200 monthly. The most recent quote is $4000 monthly.

- Gottrocks- In 2017, it was $3500, then $5000, then $17,000, then 35k, to this year, $50k (even though they closed in March)

- Josh Bumgarner, co-owner of Columbia’s Transmission Arcade, told the Chronicle that his yearly insurance premium increased from $7,000 in 2020 to nearly $65,000 when he renewed his policy in 2023. $5,000 insurance bill every month. Insurance premiums have gone up 300%.

- Phill Blair, owner of WECO Bottle and Biergarten, said the business’ insurance rate increased about 300% when it renewed the policy in October. His liquor liability insurance now costs about $50,000 a year, averaging more than $4,000 monthly.

FAQs

DOES THIS APPLY TO BUSINESSES THAT DON’T SERVE LIQUOR?

- YES. Bill S116 states, “The term’ alcoholic beverages’ means beer, wine, alcoholic liquors, and alcoholic liquor by the drink as defined in Chapter 4, Title 61, and Chapter 6, Title 61.”

ARE RESTAURANTS ALSO BEING AFFECTED?

- Yes. Restaurant rates are increasing, but they still have more options for insurance policies thanks to higher food sales. But many carriers that write restaurant policies are tightening up and looking at things like “operating hours” more closely.

- There are a lot of nuances, such as sales volume, the ratio of food to alcohol sales, and liquor or beer/wine only.

- The establishments having the most challenging time finding reasonable policy rates are bars with high alcohol sales.

HOW CAN YOU HELP? KEEP MAKING NOISE!

We’ve been told we can’t make a difference and that nothing will change unless we have deep pockets, the right connections, and lobbyists. Well, apparently, they haven’t met the SC music community.

We need to put our creativity to work.

- What can you do? Get involved. Download the flyers and posters. Print them and scatter those things like your favorite band posters. Contact us for stickers, too!

- Who do you know? Think of ways to get others involved.

- Be PROACTIVE. Send the executive committee an email at scvenuecrisis@gmail.com describing your plan of action.

- We may already have something similar in the works and we can collaborate we may ask you to RUN WITH IT! Please. We’re swamped.

- Keep the SCVC executive committee in the loop. Please don’t do anything in the name of the “SC Venue Crisis.” without talking to Tribble, Asheton, or Sheila about it first.

Call, email, or send a letter to YOUR LEGISLATORS and

district, county, and local representatives.

If you don’t know who they are, click the link above to find out.

- We’re fairly certain the legislators are aware of the issue. But county and local reps may not be. Educate them and ask them to help in any way they can. They need to know how this issue is affecting their community.

- TELL THEM YOUR STORIES.

- They need to hear from small business owners & others who will lose their income.

- Contact Gov. McMaster’s office.

- He can’t make anything happen on his own. But he can have conversations. So, ask him to address the liability insurance issue affecting YOU.

- Help us connect to SC’s small music venues, bars, and restaurants.

- We, and the legislators, need to hear from BUSINESS OWNERS in their districts. How much have their insurance coverage costs risen in the last few years?

- Help us create network hubs in Columbia, Charleston, Myrtle Beach, Rock Hill, and other SC areas.

- We can’t do this alone. We need regional leaders who will build teams familiar with their region.

- Sign the petition, share it, and sign it again. https://bit.ly/SCVenueCrisisPetition

- Follow our Facebook page.

- Share our content.

- Create your own content to help build awareness and break through the algorithm.

- Join our Facebook group. Save SC Small Venues & Small Business – Address the Insurance Crisis

- Tag people you know.

- Discuss what you’ve learned about the SC Venue Crisis online and brainstorm ways to help stop it.

- Donate to our GoFundMe account.

- Political campaigns aren’t cheap. Funds go toward the website maintenance, print materials, and getting the SCVC team to Columbia and back frequently.

The SC Venue Crisis is at it’s core, the need for lawsuit reform. It’s much larger than the SC music and bar community. We’re just focusing on this portion because this is our scene and these are our people. We’re doing what we can and hope you will, too.

Leave a comment